Publix, Winn-Dixie and Safeway give Walmart a run for the money while Lucky’s Market comes out on top as low-price leader.

Editor’s note: New for this edition of the Walmart Pricing Report, we asked veteran retailer and Produce Business columnist Don Harris to visit each store to give his observations and opinions. Please see “Don’s Notes” that follow.

February 2018 -Walmart has been heavily focused on building its online business. One reason, of course, is simply that many believe this to be the future. Walmart has three times the sales of Amazon and six times the profits, yet the stock market values Amazon as the more valuable company. This tells us that many smart people who have the ability and incentive to study the situation carefully have determined that Amazon’s model is highly scalable and likely to grow far faster than Walmart’s.

These investors likely are concerned that many of Walmart’s assets, notably its large stores, may soon become liabilities, especially if large amounts of consumer shopping move online or switch to smaller discount concepts such as Aldi or Lidl. These big stores may not be easily liquidated.

Yet, that may not be the whole story. When you read the 31st edition of the Produce Business Walmart Pricing Study, one senses that Walmart’s impact on the brick part of the bricks-and-clicks continuum is not what it once was.

So Walmart invests in online at least in part because its awesome scale may give it a competitive advantage in that space. If Amazon’s acquisition of Whole Foods heralds a new age of omni-channel retailing, then those 200,000-square-foot behemoths that Walmart operates suddenly do not look like white elephants but like hubs for digital commerce.

When we began this study, Walmart won almost every battle and won each battle handily. It was common for conventional grocery stores to come in at 30 percent over Walmart on pricing. Today that is rare. In our first report, from Connecticut, Super Stop & Shop was priced at 23 percent over Walmart, Shaw’s at 34 percent over Walmart and Big Y at 36 percent over Walmart.

For this report, the Produce Business team rolled into Fort Lauderdale, FL, and the retail reaction to Walmart’s presence is clear.

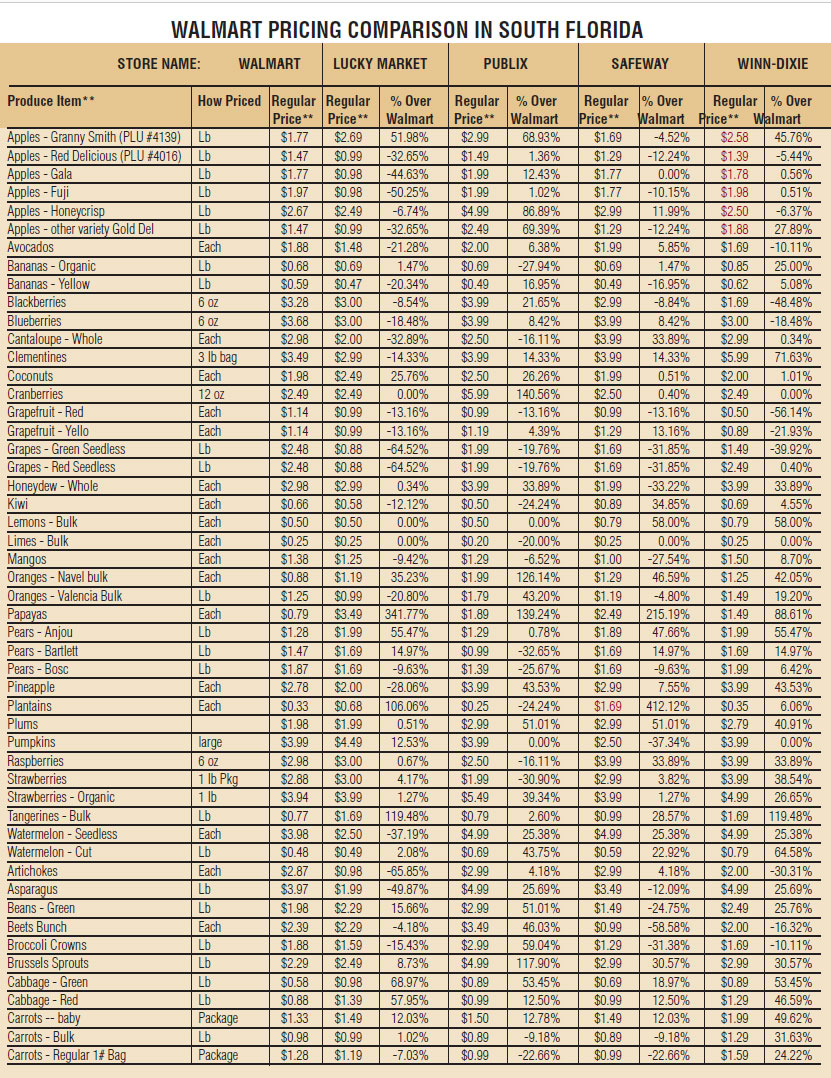

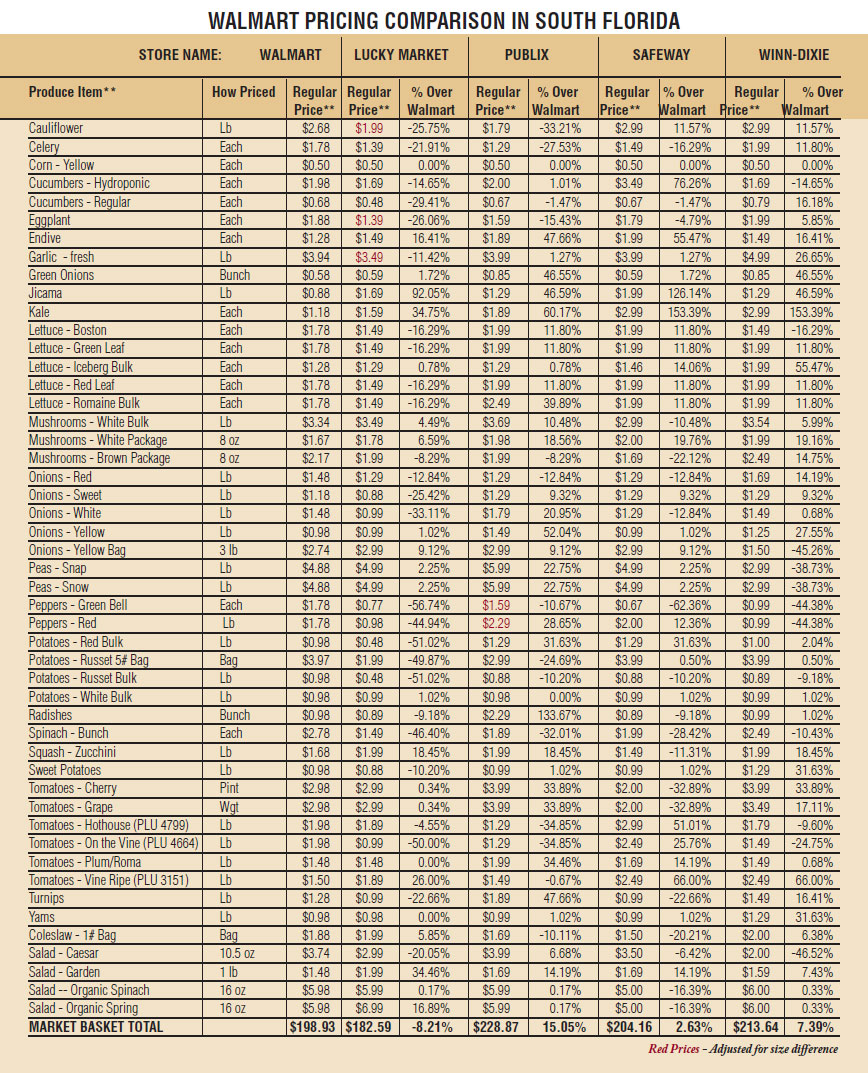

Walmart still beats conventional supermarkets but by much smaller margins. Publix, known for a high-service attitude, including tip-free delivery of goods into the cars of its customers, comes in at the top of the market with a pricing position 15.05 percent more than Walmart. Winn-Dixie is only 7.39 percent above Walmart, and Safeway is just 2.63 percent more than Walmart. Although Walmart beats these three stores on price, the difference is sufficiently small that other issues — location, ease of shopping and parking, favored private label product, etc. — easily can sway consumers away from Walmart.

When the difference was 30 percent plus, Walmart was unstoppable.

Lucky’s Market, which didn’t exist when we started this survey and only launched its second store in 2013, tries to do to Whole Foods what Walmart did to conventional grocers. But it takes pricing seriously and actually beats Walmart on pricing, coming in 8.21 percent below Walmart’s prices. Lucky’s seems to be one of many new concepts that has not accepted the idea that it must live in a world where Walmart beats it in price.

We did a separate review of where the market stands on organic produce pricing, an area that most retail executives report as hot (see table above). There is indication here that Walmart is off-trend. Although Publix is still the highest priced in organics among the retailers surveyed – 19.76 percent more than Walmart — all other retailers surveyed improved their price positioning vis a vis Walmart when looking solely at organic produce pricing. Lucky’s Market beat Walmart by 9.15 percent, Safeway beat Walmart by a narrow 2.55 percent and Winn-Dixie lost by only 1.84 percent on organic pricing.

There was a time when a store manager at Walmart could be fired for allowing other retailers to beat it on the price of high marquee items such as bananas. Yet, in this market, Publix, Lucky’s Market and Safeway all beat Walmart on banana prices. One can just hear Sam Walton saying “We never started a price war. We never lost one either.” But now, Walmart seems content to have its price leadership challenged, and not by Aldi or Lidl but by conventional supermarkets.

It is almost as if in the decades of the Walmart concept rolling across the country, other retailers have adapted and changed. And Walmart’s business model no longer provides as substantial a cost advantage as it once did. So, Walmart must look to the digital age, where its vaunted logistical abilities, its depth of financial resources and its pre-positioning in the bricks component of omni-channel retailing may yet give it back its competitive edge.

We’ll see what future editions of the Produce Business Walmart Pricing Report will have in store.

PB

Don’s Notes

Wal-Mart

The stores being placed in this part of Florida by Walmart represent the newest strategy as to the presentation of produce to the consumer. These new stores incorporate bins, euro tables and recyclable containers to present their produce, along with multi-deck refrigerated racks that form the perimeter of the department.

The true and only focus of these Walmart produce presentations is price-driven. The displays are arranged to promote the items with the most attractive pricing front and center to the consumer. All other aspects of the presentation are secondary. Signage is large and especially prominent on the displays of the key items with the most competitive prices. The key price-sensitive items are displayed forward in the department to catch the attention of the shoppers as they enter.

The other aspects of the presentation, such as the condition of the product, rotation and restocking, are sacrificed to make sure that the all-important price image is maintained throughout the department. The quality of product initially in the day is very good, but the lack of proper care of the product on display and restocking makes the product look of a lower quality than it really is.

The clerks working on the floor (when you can find one) are totally immersed in their task and avoid any interaction with the customer. Overall, the experience in the department is one of low prices on average produce. It should be noted that it was unusual to observe that Walmart’s price on bananas was not the lowest in the area. This is unusual, as Walmart has consistently been the price leader in terms of bananas.

Publix

The recognized leader in the marketplace is Publix. In many cases, the company has dominated this market for the past three decades and continues to grow throughout the area. Its go-to-market strategy is a wide variety of produce displayed on euro tables, spot displays, multi-deck wet racks and an open back room, which provides a sense of action, or “theater” for the produce department.

First and foremost in their produce operation is the presentation of abundant displays of high quality produce with a wide selection of items. Publix pricing is based on being competitive within its immediate operating area. This includes an aggressive banana price of $.49 per pound, which is one of the lowest in the area and lower than those at Walmart.

Another key aspect of the overall Publix strategy is its alignment of the produce department’s quality and selection with the neighborhood’s ethnic makeup and affluence. This type of selective marketing to fit the needs of the actual consumers in the area has proven to be very successful through the years.

There is a noticeable emphasis on service within the department (and the entire store) by having many clerks on the floor to answer questions as well as help consumers make selections while they are working on the department. The open back room concept allows for additional interaction with personnel working in the back room on prep of whole items as well as cut fruit and vegetable items. This strategy has been refined over the years as Publix was known to utilize packaged produce as opposed to bulk displays. This concept has been modified to where produce is now displayed in bulk with occasional displays of commodities prepackaged for volume sale.

Lucky’s

Lucky’s is another newcomer to the marketplace from the Midwest and West Coast. This store has a very similar type of operation as Sprouts Farmers Market and utilizes that concept to portray the image of a direct-from-the-field operation. The presentation employs high tables with large displays and a wide variety of fruits and vegetables.

Lucky’s also utilizes outdoor displays of key advertised and seasonal items to draw customers into the produce department. These entrances have rollup doors that can be utilized in good weather or enclosed during inclement weather.

Lucky’s focus is on price, and the stores utilize various strategies to attain this goal. The store visited utilizes different sizes and qualities available in the market that assist in creating lower cost, resulting in lower retail prices. This allows the store to be very competitive and, in many cases, the lowest in the area.

Lucky’s is adept at utilizing opportunity buys of produce from multiple sources to obtain product at lower cost and then work it into its displays. In the Fort Lauderdale store, Lucky’s had a large selection of organic produce located in major sections on both the dry display tables and in its multi-deck wet rack. The organic items are also priced very competitively.

Although pricing is a major focus, it also has many clerks working the floor to interact with customers, answer their questions and direct them toward the product they’re looking for. This appeal is directed at the consumer with the slogan “you don’t have to be ‘rich’ to be able to buy natural and organic food.” This is a direct challenge to the more expensive Whole Foods stores that are in the suburbs and outlying, affluent areas.

As the example of Lucky’s efforts to become the low-price produce operator in the region, its banana price was the lowest in the area at $.47 a pound.

Overall the store’s pricing will challenge Walmart’s position as the lowest price player in the area. The entire overall produce presentation will also offer an alternative to what Publix, Winn-Dixie and Safeway are offering in their more conventional presentations.

Safeway

A new banner for Florida, Safeway is making headway in a market where its parent company, Albertsons, once competed. These new Safeway units reflect the merchandising presentation of Safeway’s most successful division in the San Francisco Bay Area. Utilizing a combination of bins and display structures, multi-deck wet racks and an open preparation area for cut fruit and vegetables, Safeway is taking direct aim at Publix.

In fact, Safeway is mirroring Publix in many ways. The store visited utilizes high-quality and wide selection of premium-size produce in abundant displays to entice customers to trial. Additionally, Safeway’s prices are extremely competitive, and in many cases, lower than Publix’s.

Since this is a new entry into South Florida, it remains to be seen if this initial strategy will continue or is an attempt to influence shopper behavior and form shopping habits. Based on my experience working there, Safeway traditionally sets goals and offers support to achieve them by certain dates for all new stores.

Stores are evaluated on performance. When goals are met, stores are rewarded with additional labor hours to maintain overall presentation. These evaluations are valuable in determining whether additional stores are to be allocated to the region. Often following this period of high-level support and its subsequent success, support is ratcheted back so Safeway can maintain sales with a reduction of costs.

Winn Dixie

Retailer Winn-Dixie has been in this marketplace for many years. However, over the past couple of decades, the overall perception of quality and sales volume of this chain (other than a few remodeled stores in the area) has been declining across all of its operations. Most recent observations are that the amount of variety and selection available in the store is not up to the standards of the competition.

This lack of variety and selection provides for a presentation that is slightly sterile, with a lot of floor showing and more fixtures evident than product on the tables. In many cases, the quality and ambiance are good, but the pricing is a bit higher than similar competitors. Winn-Dixie’s experiment with pricing apples and citrus by the “each” seems to have been unsuccessful, and the chain is returning to regular pricing by the pound.

In terms of service personnel available, it was rare to find more than one clerk working in the department, and often no one was available. Unlike Publix, service did not seem to be any type of prevalent strategy to the produce operation. Pricing was not being used as a driver, nor was variety and selection along with service.

It seemed as if Winn-Dixie’s produce department was just “there,” because that’s where it was supposed to be. Given this presentation and perception, it is not difficult to see why sales and market share have been decreasing over the years.